Google Finance Advance Features: When it comes to portfolio management and real-time financial updates, Google Finance is probably the first thing that pops into your head. While it has all the basic tools you need from a finance website, Google Finance has many powerful features that can literally change the way you invest. Those tools are designed to deliver enhanced market visibility, more streamlined portfolio analysis and better informed decision-making.

In case you’re new to Google Finance then you can read our full guide here Google Finance: A Comprehensive Guide for Beginners.”

What you possibly can uncover When you are a seasoned investor working to great tune your strategies or if you’re new to the game just beginning to learn There are certain superior capabilities available on Google Finance that open doorways to boosting financial intelligence and planning strategic investment opportunities. Then follow us as we delve into the secret stores of power housed within Google Finance and learn how you can take charge over your financial landscape today.

1. Historical Data Analysis

Accessing Historical Data

With Google Finance you will get one of the best ways to access and use Historical data for free, that will allow you to see and take into account past performance of any stock/asset. To access historical data:

- Step 1: Find the Stock or Asset on Google Finance

- Step 2: Find the “Historical Data”/”Charts” And that’s it.

- Step 3: Modify the date range, so you can see historical prices, dividends, and splits.

Analyzing Trends

Having this analysis of long-term trends is absolutely critical when making investment decisions made with a full set of information. Historical prices are easily available over a certain time period through Google Finance that can be used in various ways to analyze trends.

- Charting Tools – Make Use of advanced interactive charts with over 100 technical studies and live price movements across three different timeframes.

- Technical Indicators – Include moving averages, MACD (Moving Average Convergence Divergence), or any other technical indicators that will help you to recognize the trend and possible entry/exit points.

- Comparative Analysis-Measure the relative strength and market correlations by comparing multiple assets or indices.

These tools are meant to help investors look back and make sense of the past using historical performance, providing them more understanding to what they can do with their investments in an informed strategy through data.

2. Integration with Google Sheets

Setting Up Integration

Free, live Google Sheets incorporates free real-time quotes from Google Finance and seamlessly updates financial data.

How to Integrate with Google Sheets

- Go to Google Sheets: open a new Google sheet domain or an existing one

- Google Finance Add-on Installation: Before you get started install add-on google finance in your sheet to do this go to the menu “Add-ons” then click on “Get add-ons” and search for “google finance.”

- Grant Access and Install: Click “Install” then go through the steps to allow the add-on to your Google Finance data.

- Add Functions: This allows you to bring in live and historical data with functions such as “GOOGLEFINANCE()” directly into your Google Sheets cells.

- Scheduled Refresh: Use recurring refresh intervals to ensure that your financial data is up-to-date.

Custom Dashboards

You can create the financial dashboard that you need (whatever your unique schema). One of our preferred ways to do so is in Google Sheets.

- Visualize Financial Data with Charts, Graphs, Pivot Tables.

- Formulas: Use formulas to create custom metrics from your inputs, such as portfolio performance, diversification ratios and more.

- Conditional Formatting: Automatically mark changes in numbers with a different color to differentiate the cells and give faster insights.

These custom dashboards not only make data analysis more efficient, but they also act as a centralized control center to help you monitor and manage your investments.

3. Advanced Charting Techniques

Customizing Charts

However, Google Finance has versatile charting features that allow you to create customized charts to show specific points and trends that you want.

- Day, Week or Month: Set to Day, Week, or Month to view short-term and medium-to-long term trends.

- Competitive Analysis: Galaxy allows traders quickly to see how the different assets or indices are performing without scrolling through multiple price charts at one time.

- Overlay Indicators – Layer an additional data series/metric on the chart, such as a moving average, volume or technical indicator, for enhanced analysis.

Technical Indicators

Both of these have a significant impact on trendline analysis and the use of technical indicators to inform trading decisions:-enumerate * Technical Indicators with trendlines drawn, it is also important to consider technical indicators as part of your decision-making process

- Check indicators: Look for indicators like Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI) and Bollinger Bands, etc.

- Implication: However, at the same time it is necessary to know how to interpret these indicators and be able to discover trends, confirm market momentum, as well as forecast future price movements so that you may apply the application of your teachings

- Configurable: Fine-tune indicator settings (such as periods) to reflect your unique trading or investment strategy.

Investors who develop mastery in these advanced charting techniques and technical indicators can strengthen their analytical capabilities and furthermore, improve how they manage their portfolios and make decisions.

Must Read : Google Finance: A Comprehensive Guide for Beginners

4. Real-Time Market Data

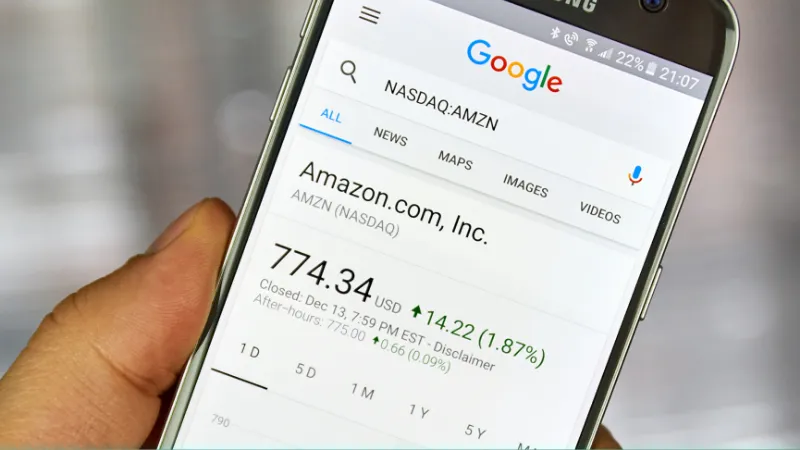

Real-Time Quotes

With Google Finance, users get certain real-time market data such as stock prices and a simple way to access the information needed to make wise investment choices. How To Read And Interpret Real-Time Quotes [Tutorial]

- Real-Time Data: Go to Google Finance platform or app and search for the stock or index you want to take a look at.

- Reading Quote Information: Understand real-time data such as how much a stock is trading at right now, how frequently it’s being traded, the range of price from bid to ask and even what the total worth of the company might be.

- Track Changes: Keep up with prices and see how many points the market moves throughout the day.

Live Market Tracking

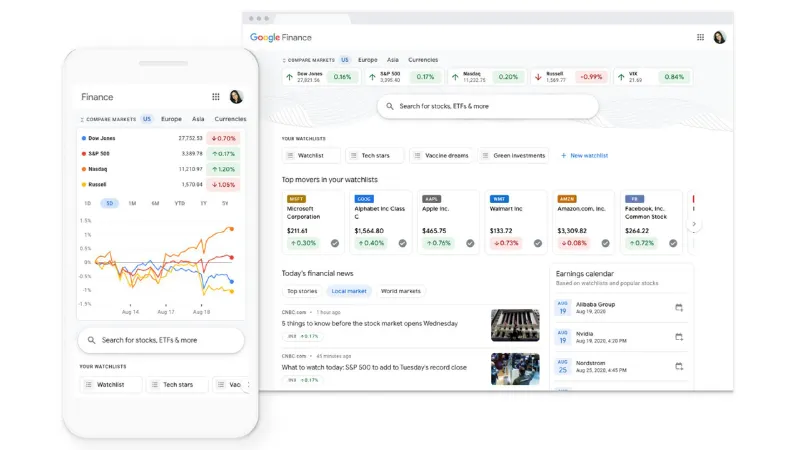

If you set up Live Tracking in Google Finance, then for the shares or indices, it will be possible to track them in real time.

- Adding stocks to watchlists – Adds open high low close (OHLC) to your watchlist of stocks and indices you long to follow.

- News Alerts and Customization: Create alerts for changes you care about, whether they be price moves, high volumes, or other triggers

- Interactive Dashboard With The Use Of Interactive Tools: Employs interactive charts and graphs to visualize current data and also discover behavior or tendencies.

With the aid of these features, investors may take advantage of real-time market data to help them in making decisions related to trading and investments.

5. Using Google Finance API

Introduction to the API

Google Finance API allows users to access financial data that can be integrated and manipulated by developers and analysts in a variety of applications. So let me just do a quick overview of what the google finance API Will be providing us with.

- Live and historical market data – This includes stock prices, company news, and market indices.

- Create Apps: API marker can be plugins to build custom applications, dashboards and even trading algorithms with that data endpoints.

- Flexible Integration: Integrate Google Finance data with other platforms, databases or software applications for larger functionality.

Basic API Calls

Make basic API requests to fetch financial data from Google Finance.

- Syntax: To fetch data endpoints with appropriate parameters through HTTP requests.

- Call Examples Retrieve stock prices, historical data and company information with easy to use API requests.

- Response Handling (e.g. document the JSON or XML responses of a query in regards to the items and/or redlining data).

Automating Data Retrieval

Scripts for data retrieval and analysis could be beneficial, improves efficiency and makes it scalable too.

- Scripting Languages : Write scripts in languages like python or JavaScript to automate api calls or process data.

- Scripted Data Refresh: Cron Jobs, or other scheduling tools, to run scripts at predefined intervals for timed data updates.

- Data Analysis: Do some data analysis, generate reports or analyze trends with automatically fetched data from Google Finance.

Because the Google Finance API has so much power, using it will create a streamlined way to manage data, advance your analytics and provide you with ground-breaking ways to supply financial applications for what you need.

6. Personalization and Custom Alerts

Customizing Your Feed

Users can customize the Google Finance news feed and the data type that is shown in each column to see what interests them most, something unique not found in other financial markets:

- News settings: Tailor your newsfeeds to see articles about key sectors, companies or themes that may be relevant to your investments.

- Data Display: Set your dashboard up so that the metrics, charts and portfolio summaries that are important to you are displayed front and center.

- Language Preferences : This setting allows you to select your favorite language for news updates as well as financial data based upon global markets and personal likings.

Setting Up Custom Alerts

Google Finance allows users to create alerts regarding breaking news that impacts their funds and also follow breaking news related to their funds so they can keep on top of developments and keep themselves ahead in the investment market.

- Alert Types: Set alerts for price spikes, volume surges, earnings announcements and more that affect your holdings.

- This part is where you choose your notification settings, by options either receiving them using email, a dedicated mobile notification or simply be alerted through Google Finance itself.

- Conditional Alerts: Establish alerts for conditions or thresholds that once met it will trigger a notification.

Additional Insights

Take advantage of your personalized feed and custom alerts to further increase your monitoring, improving your responsiveness to changes in the markets or news affecting your investments. These tools by Google Finance keeps the users on top of their finance game in this ever changing world of finances to make accurate financial decisions and manage wealth better.

Google Finance is one of the more robust portfolio management tools on the market. With real-time market data, seamless Google Sheets integration, advanced charting options, and a robust API, Benzinga Pro provides the framework for a investor’s toolset.

Through historical data insights, personalized news feeds and custom alerts, users can easily keep track of market trends and make faster investment decisions with more backup information. These enable clients to automate investment processes as well as offer greater accuracy and development of various type of portfolios.

Whether you are just starting out in the stock market or a seasoned pro, the features at Google Finance can create an optimal experience for selecting and keeping track of your many investments. With intuitive data visualization, automation features, and flexibility, users can move with certainty amid the fluidity of market conditions. Leverage the power of Google Finance advanced tools and gain a new stream of financial news that will help you in making better investment decisions based on solid researches.