- With HDFC NetBanking, you get a handy and safe way to look after your accounts, move money around, settle bills, and invest.

- Through the mobile app or website of HDFC Bank, you can use NetBanking no matter where you are or what time it is.

- With NetBanking by HDFC Bank making things easier for filing income tax returns becomes less of a headache; plus paying off credit card bills along with mobile ones doesn’t feel like much work either.

- Getting into your account is pretty straightforward—all you need are two things: Your customer ID and the password for netbanking.

HDFC NetBanking makes managing your HDFC bank accounts online super easy and safe. With it, you can do all sorts of things like moving money around, paying bills, including mobile bills, checking how much is in your account, or putting some away as savings anytime and from anywhere. All you need to get started is a way to connect to the internet and your login details.

One big plus of using HDFC NetBanking is how much time it saves you. You don’t have to wait in line or mess with checks anymore; instead, you can handle almost any banking task without leaving where you are—whether that’s home or somewhere else—as long as there’s an internet connection.

When it comes down to keeping everything secure while doing this stuff online, HDFC Bank doesn’t take shortcuts. They’ve put something called Secure Access into place which adds another layer of protection on top of what they already had – making sure no one but you gets into your account by encrypting the data with something technical (128-bit SSL encryption). This means whatever personal info like customer ID or password stays just between us.

But even with all these security measures in place at hdfc bank against cyber threats , we still gotta be smart about protecting our own netbanking accounts too! Always keep those login IDs under wraps and steer clear from logging onto sensitive sites when using public Wi-Fi spots because not every network out there has good intentions for our private information . And remember: if someone claiming toItemize being from the bank ever asks for passwords over email or phone calls—it’s probably fishy so make sure report them right off.

Getting Started with HDFC NetBanking

To kick things off with HDFC NetBanking, you’ve got to have either a Savings or Current Account with HDFC Bank. If you’re not already on board, no worries—you can easily start an account online or swing by the closest HDFC Bank branch.

With your account ready, getting registered for NetBanking is a breeze. You can head over to the HDFC Bank website or grab their mobile app. You’ll need your customer ID and the mobile number that’s linked up with the bank. Just follow these easy steps laid out on their site or app, and you’ll be all set in no time.

Once you’ve got registration out of the way, logging into your NetBanking account is smooth sailing. Use your customer ID along with your NetBanking password to get in there. Remember—picking a strong and unique password is key; it’s like keeping a secret handshake that keeps everything safe.

How to Register for HDFC NetBanking

Signing up for HDFC NetBanking is pretty straightforward. Here’s what you need to do:

- First off, head over to the HDFC Bank website or grab their mobile app by downloading it.

- Then, look for and click on either “Register” or “New User.”

- After that, punch in your customer ID along with your registered mobile number.

- Next up, an OTP (One-Time Password) will be sent over to your phone. Use this OTP to verify your mobile number.

- Now comes setting up a password for NetBanking; make sure you confirm it too.

- With that done, pick a security question and jot down its answer.

- Before finishing up, take a moment to go through and agree with the terms and conditions laid out by them.

And there you have it! You’re all set with HDFC NetBanking.

Remember once you’ve got yourself registered; logging into your account is easy peasy – just use your customer ID alongside the password created during setup. It’s crucial though not share these login details with anyone else – keeping things secure is key!

Login and Understanding Your HDFC NetBanking Dashboard

The HDFC NetBanking dashboard is like a control center for handling your bank accounts and doing different kinds of transactions. It’s designed to be easy to use, letting you find what you need without any hassle.

From the dashboard, there are several things you can do. For starters, checking how much money you have, looking at past transactions, and seeing your investments are all just a click away. If you want to move money around—whether that’s between your own HDFC accounts or to someone else’s account in a different bank—the “Transfer Funds” option has got you covered.

On top of this, the dashboard makes it simple to pay bills online and set up automatic payments so they go out on time every month. Managing both credit card and debit activities is straightforward too; whether it’s viewing recent purchases or blocking a lost card quickly.

With HDFC NetBanking, there are even more features available right from where everything happens: requesting new checkbooks when yours runs low; updating personal information easily whenever something changes; not forgetting applying for loans or getting new credit cards—all possible through exploring what the dashboard offers.

Key Features of HDFC NetBanking

- With HDFC NetBanking, filing your income tax return is a breeze. You can easily download Form 16A and interest certificates from top banks.

- Through the same platform, investing in mutual funds, fixed deposits, and various financial products becomes straightforward. It keeps you up to date with market trends so you can make smart investment choices.

- For paying credit card bills along with utility bills and insurance premiums, HDFC NetBanking has got you covered. By setting up standing instructions, bill payments are no longer a headache.

- When it comes to managing loans, tracking EMI payments or making extra payments is simple through HDFC NetBanking. This helps ensure that staying ahead of loan commitments is hassle-free.

Transferring Funds Within HDFC Accounts

Moving money between your HDFC accounts is a breeze with HDFC NetBanking. Here’s the simple way to do it:

- First, log in to your HDFC NetBanking account.

- Then, hit the “Transfer Funds” button.

- Pick which accounts you want to take money from and where you want it to go.

- Type in how much cash you’re moving.

- Decide on how fast you need the transfer – IMPS, NEFT, or RTGS are your options.

- Double-check everything looks right and then give it the green light.

Shifting funds around within HDFC doesn’t cost a dime and happens in no time. Let’s look at what makes transferring funds within HDFC so handy:

- With just a click, transfers between HDFC accounts happen instantly

- Say goodbye to extra fees because there aren’t any when moving money inside HDFC

- Day or night, even during holidays; whenever suits you best for making transactions

- Got through? You’ll know straight away with an immediate confirmation message plus a transaction number for keeping track of things

- Above all else doing this is safe as houses not mention super convenient whether youre chilling at home or busy at work

Transferring Funds to Other Bank Accounts

Moving money to different bank accounts is easy and handy using HDFC NetBanking. Here’s the way to go about it:

- With your login details, access your HDFC NetBanking account.

- Look for and click on the “Transfer Funds” option.

- Choose to move funds to another bank account.

- Fill in the details of the person getting the money, like their bank name, branch location, and account number.

- Type in how much you want to send over.

- Pick a method for transferring—IMPS, NEFT or RTGS are your options here.

- Double-check everything you’ve entered then hit confirm.

Depending on which method you pick for sending money over might mean waiting a bit before it gets there. When moving cash into other people’s accounts through this system:

- You get several ways of doing so: IMPS lets things happen instantly while NEFT and RTGS could take longer but have their own benefits too

- It’s all kept safe: The whole process from start till end is protected making sure no one else can see what shouldn’t be seen

- Keep an eye out as it happens: Watch where your money goes step by step until confirmation hits

- -The most you’re allowed to send varies with each transfer type plus what kind of hdfc netbanking profile you hold

- There might be some costs involved when shifting funds across; best check directly with HDFC Bank regarding any fees that apply

Managing Your Accounts and Cards

With HDFC NetBanking, handling your accounts and cards becomes a breeze. Here’s what you can do:

- For keeping track of your finances, you can view and download account statements online.

- When it comes to managing debit and credit cards, this service lets you keep an eye on transactions and even set how much money you want to spend.

- If ever your card goes missing or gets stolen, blocking or unblocking it is just a few clicks away.

- Need a new chequebook? You don’t have to leave home for that; request one through NetBanking easily.

- Also, updating contact info or any personal details is straightforward.

So with HDFC’s NetBanking feature at your fingertips, overseeing every aspect of your banking needs ensures everything runs smoothly without any hitches.

Viewing Account Statements Online

With HDFC NetBanking, checking out and saving your account statements online is pretty straightforward. Here’s the step-by-step:

- First off, log in to your HDFC NetBanking.

- Then head over to the “Accounts” section.

- Pick which account you want to see the statement for.

- Decide on the time frame of the statement and how you’d like it (PDF, Excel, or CSV).

- Hit either “Download” or “View.”

By using this feature, staying up-to-date with all your transactions and knowing exactly what’s in your bank balance becomes super easy. Plus, downloading these statements means you can keep them handy for whenever they’re needed next or if you have to do some number crunching later on.

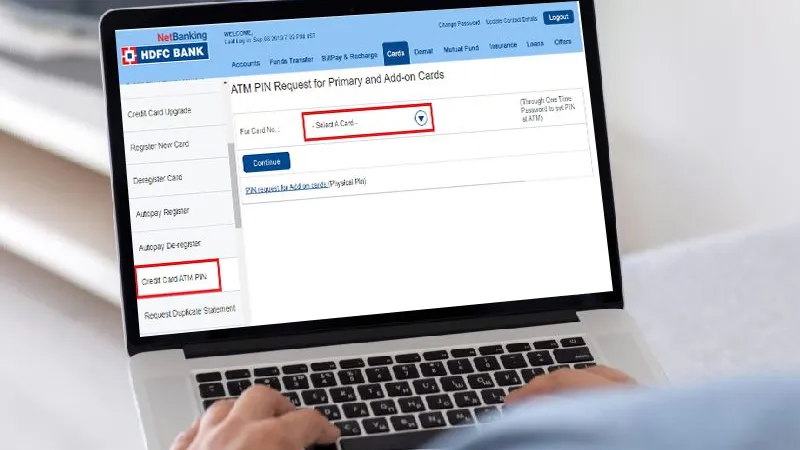

Managing Your Debit/Credit Cards

HDFC NetBanking gives you all the tools you need to handle your debit and credit cards like a pro. Here’s what it offers:

- With Card Transactions, keep an eye on what’s happening with your credit and debit card spending as it happens.

- If your card goes missing or gets stolen, Instant Card Block/Unblock lets you quickly stop or start using your card again.

- By setting Spending Limits, make sure you don’t spend more than planned.

- Use Card Statement to easily see and download statements for keeping track of expenses.

- Check out how many Reward Points you have and trade them in for cool stuff.

With HDFC NetBanking by your side, taking care of everything related to your debit and credit cards is super easy.

Bill Payments and Recharges

HDFC NetBanking makes it super easy to handle bill payments and recharges. Here’s a look at what you can do:

- For paying bills like your utility, credit card bills, insurance premiums, and others, NetBanking is really handy. You can even set up automatic payments so you don’t have to worry about them.

- When it comes to keeping your mobile phone or DTH service topped up, HDFC NetBanking lets you recharge quickly without any trouble.

By using HDFC Netbanking for these tasks, you’re able to save both time and effort since everything can be done online from wherever you are.

Setting Up Bill Payments

To pay your bills using HDFC NetBanking, it’s really straightforward. Here’s what you need to do:

- First off, log in to your HDFC NetBanking account.

- Then head over to the “Bill Payments” area.

- You’ll see options for different kinds of bills like utility bills, credit card bills, or insurance premiums – pick the one you need to settle.

- Next up, fill in details about your biller such as their name and your account number with them among other necessary bits of info.

- Decide how much you’re paying and if this is a one-off or something you want happening regularly (like monthly).

- Take a moment to check everything looks right before confirming.

After setting things up once, managing future payments gets easier. You can keep track of past transactions and even automate regular ones so they take care of themselves without needing manual input every time. Using HDFC’s NetBanking for this stuff means fewer headaches all around.

Must Read : How to Choose the Right Insurance Policy in 2024

Mobile and DTH Recharge via NetBanking

With HDFC NetBanking, recharging your mobile phone or DTH connection is a breeze. Here’s what you need to do:

- First off, login to your HDFC NetBanking account.

- Then head over to the “Mobile/DTH Recharge” section.

- Punch in your mobile number or DTH subscriber ID.

- Pick how much you want to recharge and select your service provider.

- Double-check everything and hit confirm on the recharge.

By using HDFC NetBanking, keeping up with calls or catching up on TV shows becomes super easy since you can instantly top-up your mobile phone or DTV without any trouble.

Investments and Loans

With HDFC NetBanking, managing your money gets a whole lot easier. Here’s what it offers:

- For investments, you can put your money into mutual funds, fixed deposits, and more right from home. It keeps you in the loop with market trends so you can make smart choices.

- When it comes to loans, this service lets you keep an eye on your loan accounts and EMI payments. You even have the option to pay off a bit more when possible.

By using netbanking from HDFC for all these tasks gives you one spot where all your financial details are easy to find and manage.

Applying for Personal/Home Loans

If you’re looking to get a personal or home loan, doing it through HDFC NetBanking is super easy and smooth. With your NetBanking account, finding the application form and sending it off online is just a few clicks away.

At HDFc Bank, they’ve got all sorts of loans like for homes or personal needs with good interest rates that won’t make you worry too much about paying back. So if there’s a big event coming up, maybe a wedding or you need some cash for school stuff or fixing up your house, using HDFC NetBanking means you can apply without even leaving your couch.

Plus, keeping an eye on how things are going with your application isn’t hard because everything from checking out statements to making payments can be done through NetBanking as well. And the best part? HDFC Bank gets things moving fast so waiting around isn’t something you’ll have to stress over.

Investing in Fixed Deposits and Mutual Funds

With HDFC NetBanking, you get a handy way to put your money into fixed deposits and mutual funds. It’s easy to start a fixed deposit with them; just pick how long you want it for and how much you want to put in.

HDFC Bank has lots of options for fixed deposits, giving good interest rates and the freedom to take out your money when needed. When it comes to mutual funds through HDFC NetBanking, things are pretty straightforward too. You can select from various schemes that match what you’re looking for in terms of goals and how much risk you’re okay with taking on. To help guide your choices, HDFC Bank offers up-to-date info and analyses on these mutual fund options so that deciding is easier for you.

Through this platform by hdfc bank,hdfc netbanking,you also have the power to keep an eye on how well your investments are doing; if need be, add more or pull some out whenever necessary

Security and Safety Measures

When we talk about banking online, keeping things safe is really important. HDFC Bank does a lot to make sure your NetBanking account stays secure. They use stuff like secure access, something called two-factor authentication, and they even scramble your data so it’s harder for bad guys to get it.

But it’s not just up to them; you’ve got a part to play too. You should pick strong passwords that are hard to guess, keep your antivirus software up-to-date, and watch out for sneaky phishing scams trying to trick you into giving away personal info. By staying on top of these security tips and being alert about cyber threats lurking around, using HDFC NetBanking can be both easy and super safe.

Updating KYC Online

To keep your account secure and meet the rules, it’s important to update your Know Your Customer (KYC) details. With HDFC NetBanking, this is an easy task you can do online. Just log into your NetBanking account and head over to where you can update KYC info.

You might need to upload some documents like your Aadhaar card, PAN card, or something that proves where you live for verification purposes. After everything is checked and updated, you’ll be all set to use HDFC NetBanking without any hitches.

Tips for Secure Transactions

To keep your HDFC NetBanking safe, it’s key to stick to some smart steps and stay sharp about online dangers. For starters, always bank over a private internet connection; public Wi-Fi is a no-go for these things.

Next up, make changing your password a habit – pick something tough that others can’t easily guess. Also, never ever give out your banking details or one-time passwords (OTPs) to anyone; those phishing scams are real tricky. And don’t forget to keep an eye on what’s happening in your account; if you spot anything odd, tell HDFC Bank right away.

By keeping these pointers in mind, you’ll be able to dodge unauthorized access and feel secure when handling money matters online with HDFC Netbanking against cyber threats.

Wrap Up

HDFC NetBanking is a convenient platform that empowers users to manage their finances efficiently. This comprehensive guide not only walks you through the initial steps of signing up and navigating the dashboard but also delves into more advanced features like transferring funds and settling bills online.

It equips you with the necessary information to conduct secure transactions while highlighting the ease of overseeing accounts, investments, and loans. Emphasizing the importance of maintaining security, the guide underscores the significance of updating KYC details and ensuring the safety of every financial interaction. By following this detailed guide, incorporating HDFC NetBanking into your banking routine seamlessly becomes second nature.